Quote Finder: From Shakespeare to Modern Thinkers, We've Got You Covered!

Welcome to the Quote Finder on MiniWebTool! From timeless classics to contemporary insights, our tool offers a treasure trove of quotations waiting to be discovered.

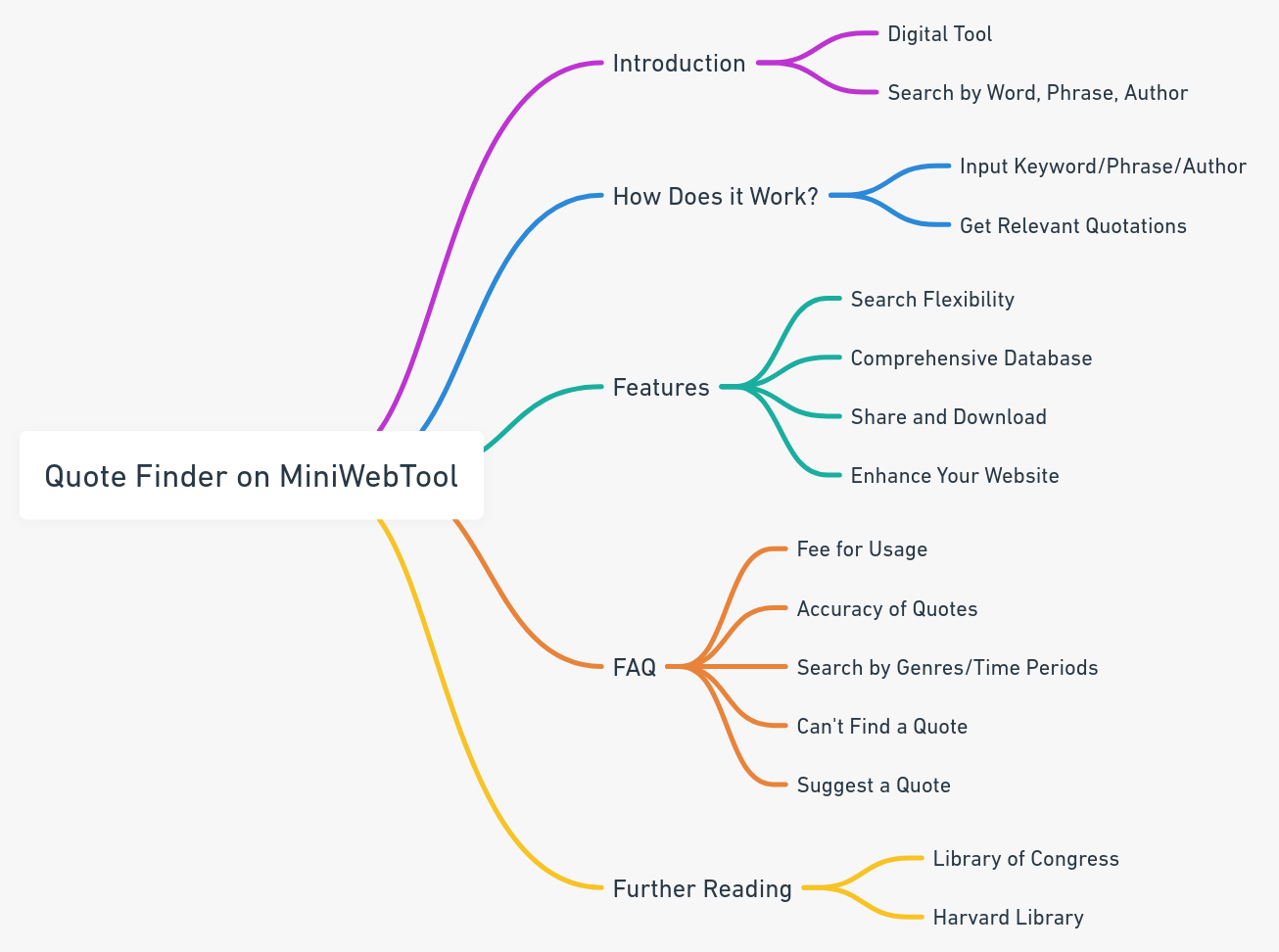

About Quote Finder

The Quote Finder is a digital tool that allows users to effortlessly search through thousands of quotes. Whether you're looking for a specific word, phrase, or author, our comprehensive database has got you covered.

How Does it Work?

Simply input your desired keyword, phrase, or author's name, and let the Quote Finder do the magic. In seconds, you'll be presented with a list of relevant quotations.

Features of the Quote Finder:

1. Search Flexibility:

Search for your favorite quotes using specific words or delve into the wisdom of renowned authors.

2. Comprehensive Database:

From historical gems to contemporary thoughts, our vast database ensures you find the quote that resonates with you.

3. Share and Download:

Found a quote that touched your soul? Share it with the world or download it for keepsake.

4. Enhance Your Website:

Website owners can seamlessly embed our tool, offering visitors an engaging experience.

FAQ

No, the Quote Finder on MiniWebTool is free to use. If you find value in this tool, kindly spread the word among friends or consider linking to us from your website.

The Quote Finder primarily allows users to search by words or authors. For specific genres or time periods, you might need to include those terms in your search query.

Further Reading

Reference this content, page, or tool as:

"Quote Finder" at https://miniwebtool.com/quote-finder/ from miniwebtool, https://miniwebtool.com/

by miniwebtool team. Updated: Oct 08, 2023